Wynn Could Have Lengthy UAE Casino Monopoly

Regulatory Advantage For Wynn

Wynn Resorts’ Wynn Al Marjan Island integrated resort іn the United Arab Emirates (UAE) іs expected tо open іn early 2027, perhaps several months sooner, and when іt does, the casino hotel will enjoy a potentially lengthy monopoly іn the emirates.

The reason for that advantage is because the General Commercial Gaming Regulatory Authority (GCGRA) — the UAE’s first gaming regulator — isn’t rushing the approval of additional casino licenses over the near term.

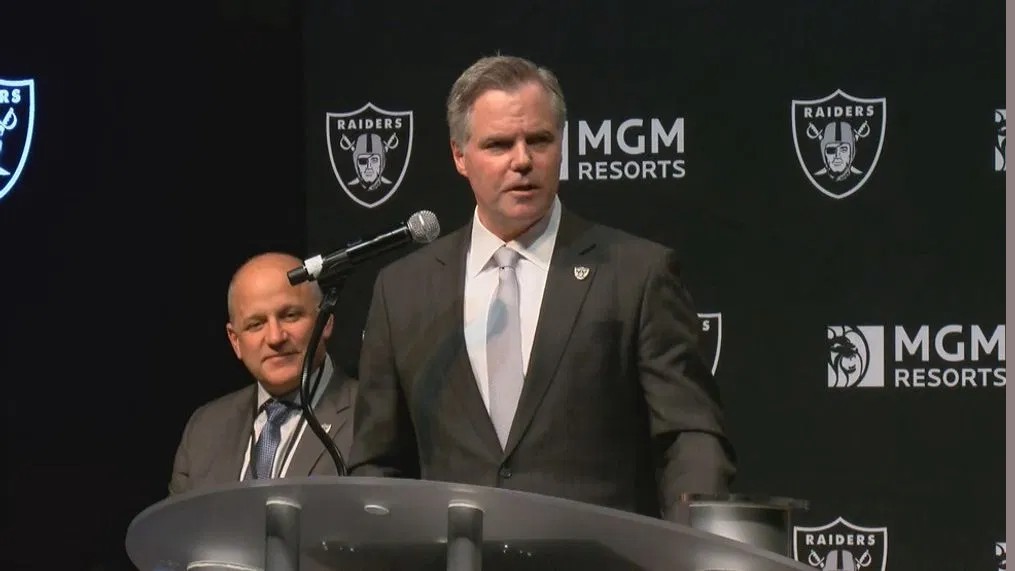

“The process is moving very deliberately here. The government has been very clear it wants a state-of-the-art, very compliant, very rigorous regulatory regime. Nothing we’re doing will rush that,” said GCGRA Chairman Jim Murren at the Skift Global Forum East 2024 earlier this week.

The GCGRA was formed in September 2023. It’s been less than two months since the regulatory body approved a gaming license for Wynn Al Marjan Island, which is located in the emirate of Ras Al Khaimah, marking the first such approval in the history of the Arab world.

Pragmatic Licensing Approach

At the conference, Murren emphasized that a pragmatic approach to the issuance of casino licenses is “incredibly important” to the UAE government, adding that the GCGRA is focused on the operators to which it’s granted permits.

That’s Wynn and a lottery operator in Abu Dhabi, indicating that while Wynn won’t have a permanent monopoly in the emirates, it will enjoy a significant head start over any competitors looking to enter the market. Those include MGM Resorts International, the company Murren previously led.

“We’ll see other integrated resorts in the UAE over the next five to 10 years, but Wynn has the head start,” said Murren.

He didn’t get into specifics, but it appears Wynn’s UAE monopoly will span at least several years.

Earlier this year, MGM confirmed it would like to pursue a UAE gaming license and that there is space for a casino set aside at its hotel in Dubai, which is currently structured as a non-gaming venue. Owing to its status as the region’s prime tourist destination and the vast petroleum wealth possessed by some locals, the UAE is a compelling market for gaming operators, implying new licenses are worth waiting several years for.

Future Of UAE’s Casino Market

Though he drew comparisons between the UAE today and Las Vegas 30 years ago, Murren didn’t get into the exact amount of gaming venues that could eventually call the emirates home. What is clear is that the number will never be comparable to that of Las Vegas or Macau and that analysts and executives largely view UAE as a four-casino market, including Wynn Al Marjan Island.

Four integrated resorts could be enough to make the emirates a $3 billion to $5 billion market in terms of annual gross gaming revenue (GGR) and potentially rank it fourth in the world behind only Macau, Nevada, and Singapore.

Some analysts estimate UAE’s total addressable gaming market could be as high as $8.5 billion, but that figure implies going beyond four casino resorts and more liberalized views toward gaming in the countries closest to the emirates.

Сheck out the other news!